Driving under the influence of drugs or alcohol is a serious crime across the United States. Cars and motor vehicles are powerful machines that can cause severe damage if involved in an accident. When a person is intoxicated their inhibitions are lowered making them more likely to engage in risky behavior and unable to perform certain motor functions properly. Being charged with a DUI or DWI can impact your life in multiple ways. You can be seriously injured, cause property damage, or be responsible for the injury or death of another person. Some may worry that a DUI will show up on your credit report. While this is not the case, it can still impact your credit score. For more information on the consequences of being convicted of a DUI and how it can affect your credit report, speak with an experienced Bergen County DWI attorney.

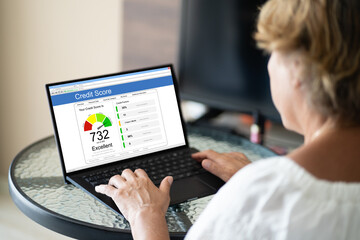

Credit scores are important in American society for various reasons. They represent a person’s financial history and responsibility. Companies use your credit score to determine whether or not they are willing to offer you a mortgage, car loan, credit card, and more. The numerical value shows at a glance if you have been responsible in borrowing and paying back money in the past. A credit score may be needed to purchase a home, rent an apartment, open a line of credit, start a business, etc. Your credit score also impacts the interest rate you are given on these loans. The better your credit score the lower the interest rate you will be charged.

Contrary to what some may believe, a DUI conviction does not show up on your credit report. It does not appear on your report nor does it factor into your credit score. With that being said, being convicted of a DUI can still impact your credit rating.

The penalties for a DUI can be devastating and include hefty fines. Depending on your case you could be charged hundreds if not thousands of dollars. A first-offense DUI charge for a BAC of over 0.08 can be punished with fines of up to $500 depending on your BAC. You may also see:

This is not to mention attorney fees, court fees, and compensation paid to any victims. If you are convicted of a DUI your immediate costs will be extensive and you could accumulate a lot of debt in a short period of time. Your conviction could limit your ability to maintain or obtain employment, especially if you are facing jail time. You may find yourself struggling to pay your fines and credit card bills. This could result in an accumulation of interest on late payments and a steep decline in your credit score.

© 2026 The Law Office of Kevin T. Conway. All rights reserved.